The Greatest Guide To Home Owners Insurance In Toccoa, Ga

Table of ContentsThe 4-Minute Rule for Annuities In Toccoa, GaNot known Facts About Annuities In Toccoa, GaIndicators on Final Expense In Toccoa, Ga You Should KnowThe Ultimate Guide To Final Expense In Toccoa, GaCommercial Insurance In Toccoa, Ga Fundamentals ExplainedSome Of Commercial Insurance In Toccoa, Ga

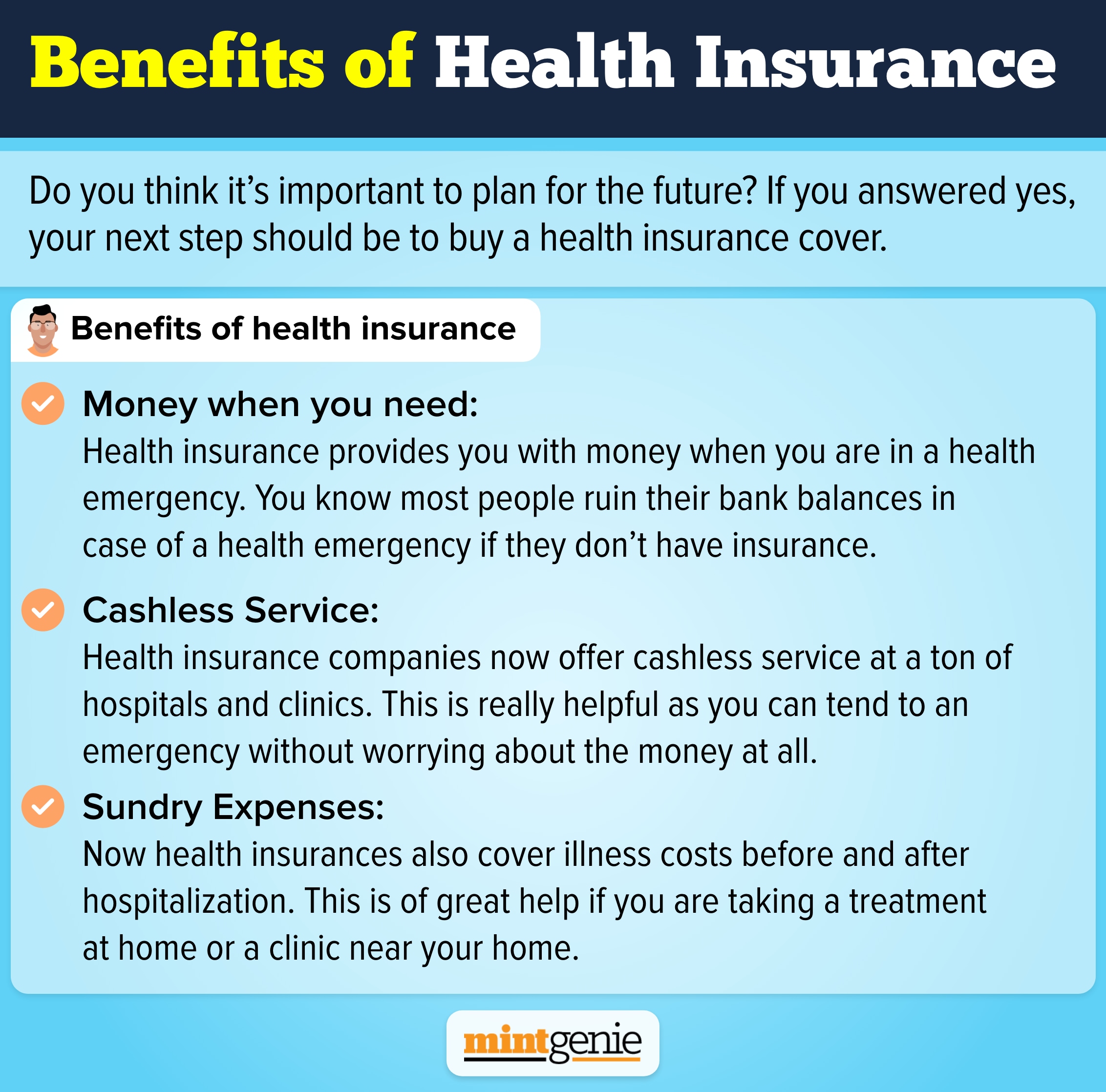

See if you are eligible to make use of the Health and wellness Insurance Industry. To be eligible to sign up in health and wellness coverage via the Marketplace, you: Under the Affordable Treatment Act(ACA), you have special person security when you are insured with the Health Insurance Policy Marketplace: Insurance firms can not decline coverage based on gender or a pre-existing condition. Some legal rights and securities use to plans in the Wellness Insurance Coverage Marketplace or other specific insurance coverage, some use to job-based plans, and some apply to all wellness coverage.With clinical costs soaring, the requirement for personal wellness insurance policy in this day and age is a financial truth for lots of. Within the group of exclusive

health insurance, there are significant differences between a health health and wellness handled CompanyHMO)and a preferred favored organization(PPO)planStrategy Of training course, the most obvious advantage is that private health insurance can provide coverage for some of your healthcare expenses.

Not known Facts About Health Insurance In Toccoa, Ga

Lots of individual policies can cost numerous hundred bucks a month, and family protection can be also greater. And even the much more detailed plans featured deductibles and copays that insureds must satisfy before their protection starts.

Most health insurance have to cover a collection of precautionary services like shots and testing examinations at no expense to you. This includes plans readily available via the Medical insurance Marketplace. Notification: These solutions are complimentary only when delivered by a medical professional or various other company in your plan's network. There are 3 collections of cost-free preventive solutions.

Some Ideas on Annuities In Toccoa, Ga You Should Know

When you get insurance, the regular monthly costs from your insurer is called a premium. Insurance policy companies can no longer bill you a greater costs based upon your health standing or due to pre-existing medical conditions. Insurer providing significant medical/comprehensive plans, established a base price for everyone who gets a medical insurance plan and afterwards readjust that price based upon the factors listed here.

Normally, there is a tradeoff in the costs quantity and the prices you pay when you obtain care. The higher the monthly premium, the lower the out-of-pocket expenses when you get treatment.

For even more details on types of wellness insurance, contact your company benefit representative or your financial specialist. In summary, below are some of the pros and disadvantages of using exclusive health insurance coverage.

Annuities In Toccoa, Ga Fundamentals Explained

Most wellness plans have to cover a collection of preventive solutions like shots and screening tests at no expense to you. This consists of plans available via the Health Insurance Policy Market.

When you buy insurance policy, the monthly costs from your insurance provider is called a premium. Insurer can no more charge you a greater premium anonymous based upon your health condition or as a result of pre-existing medical problems. Insurance business offering major medical/comprehensive plans, set a base rate for everyone who acquires a health insurance policy strategy and after that readjust that price based on the aspects listed here.

Normally, there is a tradeoff in the costs quantity and the costs you pay when you get treatment. The greater the monthly premium, the reduced the out-of-pocket prices when you receive care.

Affordable Care Act (Aca) In Toccoa, Ga Can Be Fun For Everyone

Most health plans should cover a set of precautionary services like shots and screening tests at no cost to you. This includes plans available through the Health Insurance Marketplace.

When you acquire insurance policy, the regular monthly expense from your insurance company is called a costs. Insurance coverage companies can no much longer charge you a higher costs based on your health standing or because of pre-existing clinical problems. Insurance firms using major medical/comprehensive plans, set a base price for everybody that gets a medical insurance plan and after that change that price based on the variables provided below.

The Annuities In Toccoa, Ga Ideas

Typically, there is a tradeoff in the premium amount and the prices you pay when you get care - Commercial Insurance in Toccoa, GA. The greater the regular monthly premium, the reduced the out-of-pocket expenses when you receive treatment

Michael Oliver Then & Now!

Michael Oliver Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!